Leaning selectively against the wind

Most asset market returns can be distilled down to two basic elements: movements in cash flows and discount rates. In the past month or so, for risky assets such as equities, each has moved in a broadly friendly direction. Expectations around earnings, which are the dominant source of cash flows for equity investors, bottomed for global stocks in mid-May, and as the earnings season progressed, so did analyst optimism on the path of future earnings. Notwithstanding the savage fall in delivered earnings in the second quarter, future expected earnings for the MSCI All Country World Index have moved such that by the end of next year, earnings are now expected to be a whisker above where they were last December.

Policy, meanwhile, is ultra-easy; and, notwithstanding a soggy August for core government bond returns, short-end discount rates across developed markets are priced to stay very low (in the US) or negative (in Europe) for at least the next five years. The Fed’s new policy framework may further entrench these dovish trends.

Earnings, the macro backdrop, and valuations

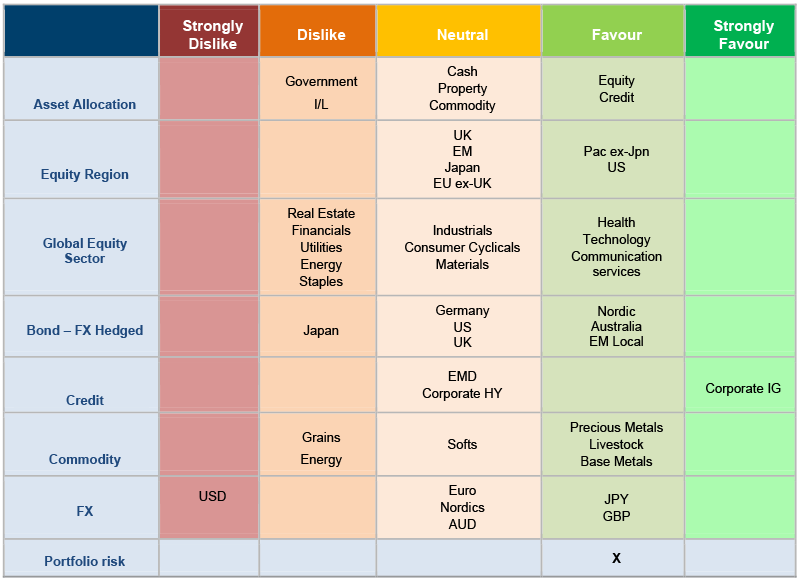

So why, then, have we started to selectively lean against the wind? For three chief and interrelated reasons: less positive regional earnings (or cash flow) trends under the bonnet of global aggregates; our broadly cautious macro view, with economic growth expected to be towards the bottom decile of consensus expectations in most areas this year; and fuller valuations, after a period of exceptionally strong returns, in areas of fixed income for example.

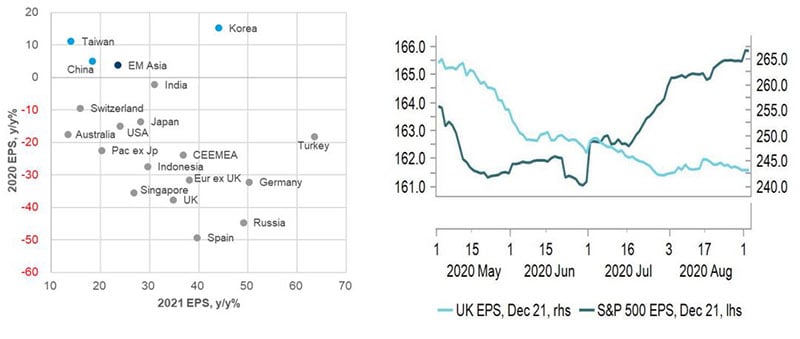

Aggregates often mask underlying trends – and while earnings expectations in the US, which dominates global indices, have recovered smartly, this is not the case in any other regional bloc bar emerging Asia1 .

To be sure, EM Asia stands out as the only region expected to deliver positive earnings growth in 2020 and 2021 (Figure 1, lhs) and, together with the US, is where we concentrate our equity risk2. The UK and, to a lesser degree, Europe-ex UK have seen sharp falls in earnings this year, and expectations for end-2021 earnings have been moving lower and in the opposite direction to the US and EM Asia (Figure 1, rhs). Added to the mix are the challenges of: Brexit; a prospective unemployment cliff in October as furlough schemes fade; and a market whose composition skews the index toward value factors that will be challenged in the environment we envisage – more on this below.

Collectively, these developments led us to clip our UK equity exposures in the third week of July, moving to underweight in our asset allocation grid. Anaemic expected earnings growth and fresh Covid concerns have also held us back from taking cyclical exposure through European equities, preferring instead to be long the euro that stands to benefit from important policy shifts, like the EU recovery fund and ultra-easy global policies, but without the cyclical sensitivity of equities.

Figure 1: A mixed bag of earnings… with different end points for 2021

Source: Macrobond, 2 September 2020.

Macro forecasts

Tilting against broader cyclical, value-led or indeed small-cap exposures at the current juncture is buttressed by our distinctly cautious macro views. Although widespread economic shutdowns delivered less of a knock to second-quarter GDP than we feared (leading us to mark higher our 2020 US GDP growth forecasts last week – to -5.5% from -7.5% previously), our macro forecasts remain distinctly cautious. Indeed, the upgrade to 2020 US growth was accompanied by expectations for a softer 2021. In Europe, the UK and Japan, we are in or very close to lowest decile for growth in 2020, expecting real GDP to return to end-2019 levels sometime after December 2021 (between a U- and L-shaped recovery in current parlance). And risks abound, from sharp falls in employment as furlough schemes end, to uncertainty around the US Presidential elections and fears of fresh lockdowns on a second wave of Covid.

One corner of financial markets that has come a long way since the first Covid wave is corporate credit, and in particular investment grade credit. At the wides of March, investment grade corporate bonds were compensating investors for 50 times the normal default rate and were trading around 2.5 standard deviations cheap to long-run averages3.

After a punchy rally, valuations are now slightly rich to long-run averages. While higher-quality corporate bonds trade above fair value about 60% of the time, have more robust balance sheets than other segments of the credit market and remain an important beneficiary of central bank policy, the supernormal profits that we sought to capture in asset allocation portfolios have now dissipated. So in the final week of August, we lowered our preference for higher grade corporates to favour – on par with high yield. We continue to dislike core government bonds, however, where risk/reward at present valuations is very poor.

As before, these moves do not put us in a defensive mode: indeed, we remain quite exposed to both equity and credit risk. Lower effective discount rates are a powerful support as economies recover and we are keen to be long assets that stand to benefit most. But as markets have rallied, and risks shifted, we are selectively leaning against the wind in more cyclical areas.

Source: Columbia Threadneedle Investments, 2 September 2020.