More than any other central bank, the Bank of England (BoE) is in a hurry to reduce its balance sheet, running up huge losses for the taxpayer. Is this another “selling gold at the bottom” moment?

Move over QE or Quantitative Easing. Quantitative Tightening (QT) is the order of the day. Money printing is in reverse and balance sheet reduction – selling the government bonds bought during the QE era – is now a focus of central banks. Just like QE before it, the precise terms of these sales are watched keenly by the market, with knock on implications for borrowing costs for governments, corporates and households alike.

Other central banks are treading gently. Selling bonds on this scale has never been done before. Nor has it been tried when bond markets have had to digest the ramifications of both high inflation and substantial rate hikes. Prices for bonds are today much lower (and yields higher) than when the central banks bought the same securities previously. So understandably, central banks are cautious in trying to sell those bonds back to the market and proceeding slowly.

But not so the Bank of England.

Of all the central banks, the Bank of England has been the most aggressive in terms of selling the bonds it bought during the QE era. The process itself involves the Bank of England both allowing bond holdings to mature without replacing them, and also selling its bond holdings into the market. This is not unusual. But what is unusual is the pace and scale of these activities.

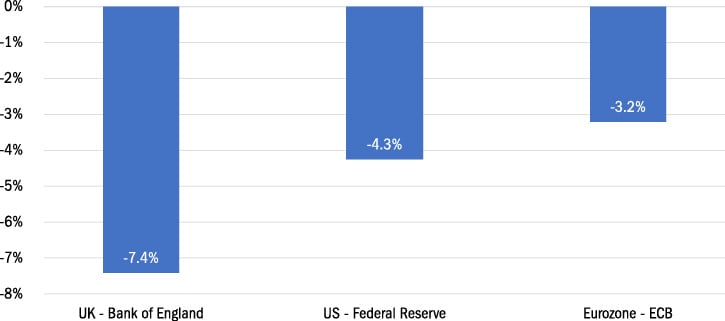

Adjusting for the sizes of the different country’s bond markets in the UK the net effect is equivalent to sales of about 7.4% of outstanding government debt. This is around 70% faster than the pace of the US Federal Reserve and well over twice the pace of the European Central Bank. It is unclear why the Bank is so hasty. The fast pace of gilt sales pushes down on prices, worsening the losses, and worse, crystalises the paper losses into a drain on the UK taxpayer.

The BoE is hurriedly reducing its balance sheet – going much faster than other central banks

(Decline since peak in the share of government debt held by the central bank)

Source: Bloomberg, Columbia Threadneedle

The losses of the QE experiment are huge. Even the BoE’s own numbers project eyewatering losses. Figures published by the Bank in August suggest over its lifetime, QE is likely to cost the state a net £110bn, around 5% of GDP1. The BoE is choosing to rush to crystalise this loss now, rather than going slow or waiting for interest rates to go back down. Despite being mandated to support the “wider economic objectives” of the government, the Bank of England is rebuffing questions about these losses with Deputy Governor Ramsden stating: “The MPC does not take into account financial risk or profit when taking monetary policy decisions, including about the gilt portfolio”2.

For markets, the pace of such hefty selling pressure by the UK central bank could be one factor why gilts have struggled to attract buyers this year. Historically UK government bonds were able to attract buyers without paying a premium to US Treasuries. Not so anymore. With QT – and of course many other factors – costs to borrow for the UK government now comfortably exceed those of the US.

Since the start of QT, borrowing costs have gone up much more for the UK than the US

(Government bond yields. %)

Source: Bloomberg, Columbia Threadneedle

Estimating how much of this change relative to the US comes from the hurried pace of QT in the UK is guesswork. Other dynamics are at play, including the worse inflation outlook in the UK or the impact of the Kwarteng budget. But if the extra QT accounted for half the change relative to the US, then the extra QT could be adding 0.4% per year to the borrowing costs of the UK government, based on the 10-year bonds3.

The reputation of the UK central bank took a beating when the UK infamously sold its gold holding at the bottom of the market. Blame for that decision is shared with the government of the time. But from a taxpayer point of view, the way the Bank went about implementing that those bullion sales left much to be desired. There are many parallels with the way the Bank is operating today. Similar preannouncements of sales are used, depressing prices. Similar disinterest is expressed by the BoE in the prices achieved and or scale of losses crystalised. And ahead of the next MPC meeting on 21 September similar fears exist in the market that the pace of sales might even increase. But if history rhymes with the past, the actions of the Bank of England could again mark the bottom of the market. For investors, with inflation now coming down and peak rates in sight, this could be an opportunity.